Do you need to keep a payment stub as an employer?

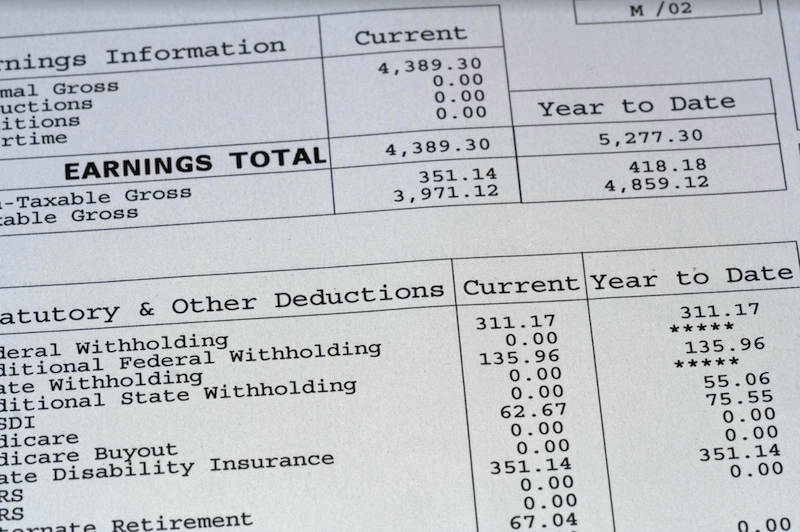

Payment stubs are part of payroll records. It can be a paper document or an online one. It helps employees keep track of their salary information and serves as proof of income.

While the importance of payment stubs for employees is well known, it might not be the case for employers. They’re sometimes required documents to meet government recordkeeping standards. Even if payment stubs aren’t mandatory, it may still be wiser to do so.

If you’re asking if you do need to keep payment stubs, read on because here’s what you need to know.

Law Requirements

Under federal law, retaining basic information on each employee is mandatory. Federal law doesn’t require employers to issue or keep payment stubs. However, the Fair Labor Standards Act has guidelines for payroll documentation.

The employee information to keep includes:

– Full name, address, and Social Security number

– Gender and occupation

– Date of birth (for employees under 19)

– Date and time of each work week’s start and end. The date of the payroll period is also required (if the payroll period is different from the work week)

– Date of payment

– Hours worked (daily and weekly)

– Pay rate

– Regular wages and overtime pay (plus any other additions or deductions)

This is why it’s prudent to keep all records, be it a printed copy of the payment stub or an invoice with payment stub. You can check here for pay stubs for self-employed individuals.

Needed Source Documents

You can have your employees use a time clock to record their start and stop times. They can also make manual time reports. You’re allowed to accept a timekeeper’s report on each employee’s work hours under federal law.

Other Requirements

In general, employers must keep payroll information for 3 years. If you used payment stubs to record some of the data, you must also keep them for 3 years. You must also retain time cards or other equivalent records of time worked for 2 years.

The Equal Employment Opportunity Commission requires employers to keep all records for 1 year. This includes pay stubs and payroll records. Additional recordkeeping requirements can also be mandatory in certain states.

For instance, the Texas Workforce Commission requires employers to issue a payment stub. It should list all the data used in preparing a check.

They must also keep payroll records for 4 years. This is part of Texas unemployment compensation recordkeeping guidelines.

Where Should You Store the Records?

Employers should maintain payroll records in a safe location according to federal law. This can be at the employee’s work location or the employer’s main site.

You must be able to produce files in case an inspector from the Department of Labor asks for an examination. You must complete this within 72 hours after the request.

Now You Know What to Do for Payment Stubs

There are legal guidelines on payment stubs even if they aren’t required under federal law. It’s better for you as an employer to keep them. Here’s everything you need to know about keeping payment stubs.

Thanks for reading our article! Are you self-employed? Check out our other blog posts for more helpful guides.